Big Red Horse supports energy, power, and commodities trading organizations in defining and executing long-term strategies for complex analytics and data platforms. Work sits at the intersection of market fundamentals, trading workflows, and market intelligence across natural gas, power, LNG, and related derivatives.

Engagements combine strategic product thinking, market fundamentals expertise, and data platform architecture to help organizations move from ad hoc tools and overlapping systems toward coherent, long-term analytics strategies. Emphasis is placed on future-state product visions, portfolio rationalization, and scalable architectures that support new analytics capabilities, scenario tooling, and evolving commercial models over time.

Platform & Product Strategy

Defining future-state roadmaps for analytics, datafeeds, and market intelligence products, including clear roles, boundaries, and evolution paths.

Analytics & Data Products

Designing and launching dashboards, APIs, scenario tools, and decision-support workflows grounded in trader and analyst use-cases.

AI-First Development

Building fullstack analytics solutions that centralize dataflows and implement new intelligence layers supporting risk, P&L visibility, and trading workflows.

Architecture & Vendor Rationalization

Evaluating technical delivery approaches, remediating legacy platforms, and aligning vendor contracts and entitlements with strategic priorities.

A product and strategy leader across the commodity data and analytics space — defining portfolio-level roadmaps for oil, gas, LNG, and biofuels intelligence products, shaping go-to-market positioning for real-time data services, and driving architectural decisions that determine how trading organizations consume and act on market fundamentals. Deep domain expertise in natural gas supply and demand dynamics, pipeline operations, storage analytics, and global LNG cargo tracking.

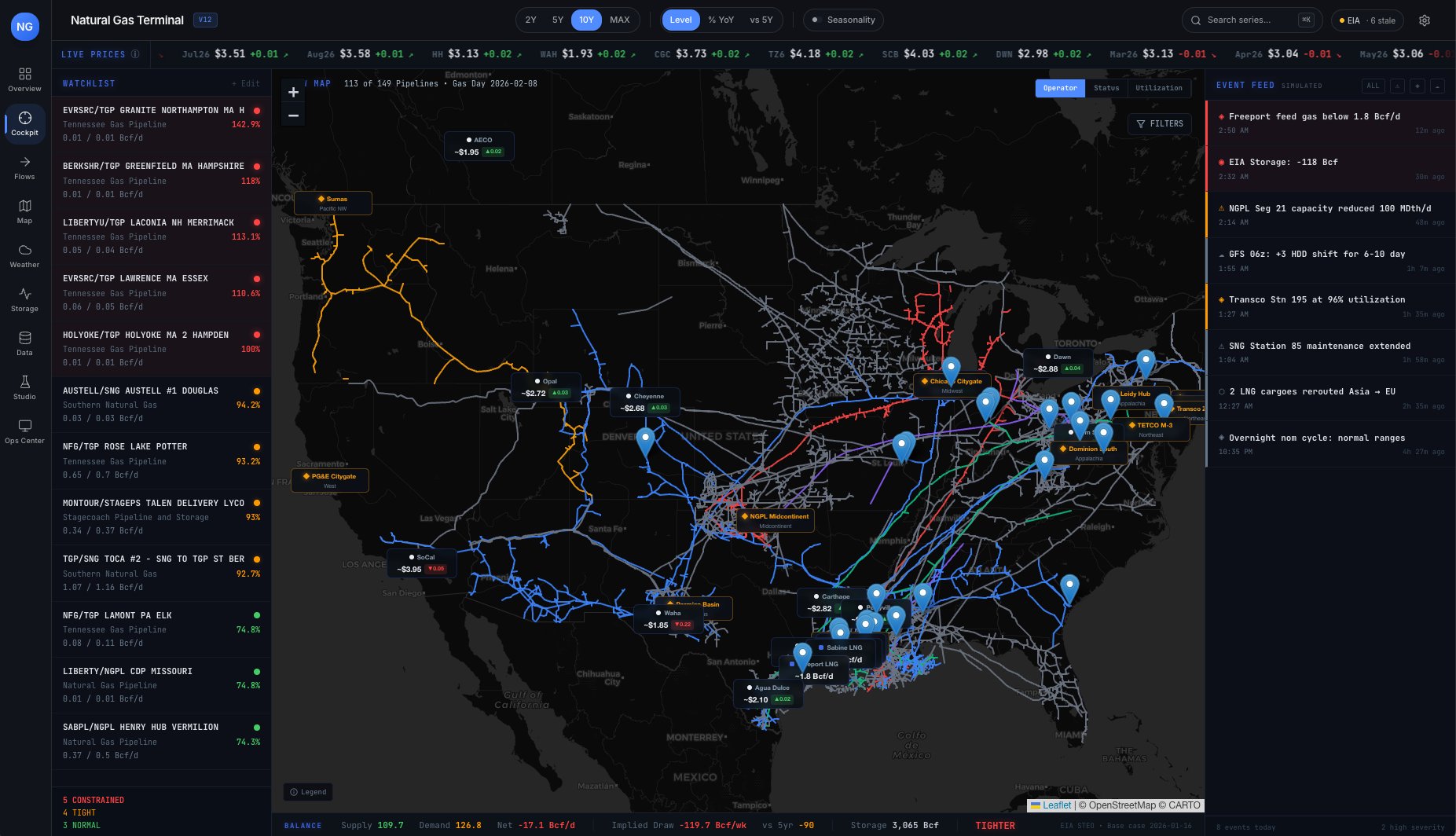

Beyond strategy, a hands-on builder. Designed, architected, and deployed a continental-scale natural gas pipeline intelligence platform covering 150+ FERC-mandated electronic bulletin boards with sub-minute data latency. The system automates what was previously a fragmented, manual process — collecting, normalizing, and surfacing operational flow data from across the US pipeline network into a single unified layer. The technical stack spans automated scraping engines, data normalization pipelines, REST API services, and a real-time monitoring dashboard with interactive pipeline mapping, flow visualization, utilization tracking, live pricing overlays, and an event feed synthesizing weather, infrastructure, and market signals into a single operational view.

Currently building out Kpler's North American natural gas data and analytics business.

Cattle IQ

Big Red Horse also developed Cattle IQ — a data platform and automated collection engine built to give producers, sale barns, and cattle market professionals comprehensive auction pricing data across regional markets in one tool. By combining USDA market reporting with programmatic data feeds from individual sale barns, Cattle IQ delivers pricing visibility across cattle classes, weight specifications, and regional markets that previously required manually checking dozens of sources. Helping producers make data-driven decisions about where and when to sell.